Identify the regulatory agencies responsible for regulating insurance and reinsurance companies. 11 Which government bodiesagencies regulate insurance and reinsurance companies.

Pin On Personal Injury Lawyer 203 361 3738

Who Regulates Insurance.

Who regulates insurance companies in the us. For example insurance companies and policyholders have to abide by state contract laws such that a failure to honor the terms of the policy may constitute a breach of contract. The name of the insurance regulatory agency typically is Department of Insurance Division of Insurance Insurance Bureau or something similar. The regulation of insurance companies is split between the states and the federal government.

Currently there are approximately 7200 insurers in the United States. The ABI is not a regulator but we do. Answer 1 of 3.

Franklins company was the first to make contributions toward fire prevention. He has worked on personal injury and sovereign immunity litigation in addition to experience in family estate and criminal law. Since insurance was defined as an intangible good its regulation fell to the individual states.

Regulation of Agents. Each of the 50 states regulates the operations of insurance businesses within its borders and has its own laws concerning the appropriate contractual terms that. Click to see full answer Similarly who regulates the insurance industry in the US.

Competitive rating laws provide a number of benefits to insurance buyers. There is not a federal regulating body for insurance such as the Securities and Exchange Commission which regulates the securities industry. Each state also specifically approves products sold in that particular state.

There are numerous insurance companies and none is large enough to control the market. Insurers are subject to regulation in their state of domicile and in the other states where they are licensed to sell insurance. The individual states generally have some department is involved in regulation of th.

These plans are still regulated at the state level. 484 1945 although he also discussed the reasons justifying rate-fixing by insurance companies. There is no federal regulatory agency that oversees insurance companies.

In the financial industry they receive the financial regulatory supervision and authorizations issued by the Prudential Regulation Authority PRA the agency that provides supervision and regulation for insurance companies and the Financial Conduct Authority the. The Financial Conduct Authority FCA regulates how these firms behave as well as more broadly the integrity of the UKs financial markets. There is some regulation of insurance companies on the federal level.

Insurance regulation is dominated by state laws due to insurance not considered to be a tangible good. Insurance companies naturally preferred to be subjected to a less stringent state antitrust scheme. However this regulation is primarily with respect to national insurance programs such as the National Flood Insurance Program.

A company domiciled in NY but selling in all 50 states is liable to audit not only by NY but also by CA FL and every other state it sells in. State has a department of insurance that handles licensing regulation and complaints against insurance companies. Insurance Companies are Licensed Businesses.

The name of the regulating body varies from state to state but can usually be found under Department of. Employer-based healthcare that is fully insured works like this. Because car insurers operate as licensed businesses they must obtain business permits licenses and tax permits from the communities and states they operate in.

It is a fact that the UK regulates two kinds of insurers. Life insurance companies are regulated by the individual states in which they are licensed or certified to sell insurance. One is lower rates.

Insurers are regulated by all states they sell in. Many state insurance laws violated both the Sherman and Clayton Acts 91 CONG. In the US insurance business including reinsurance is primarily regulated at the state level.

Insurance companies in the United States are regulated primarily by the individual states. The first insurance company in the United States underwrote fire insurance and was formed in Charleston South Carolina in 1735. A business is not required to be licensed in all 50 US.

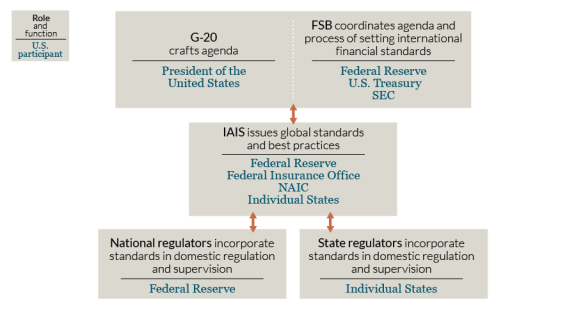

Please see McCarranFerguson Act – Wikipedia and McCarran-Ferguson Act of 1945. FIO has the authority to monitor all aspects of the insurance sector monitor the extent to which traditionally underserved communities and consumers have access to affordable non-health insurance products and to represent the United States on prudential aspects of international insurance matters including at the International Association of Insurance Supervisors. Insurance regulatory law is primarily enforced through regulations rules and directives by state insurance departments as authorized and directed by statutory law enacted by the.

Insurance Company Obligations. The regulatory agency is usually called the Department of Insurance but it is also known by other names or included as an agency of another department such as the state Department of Revenue. Are Insurance Companies Regulated In The Uk.

According to the Insurance Information Institute there were over 2500 propertycasualty insurers operating in the United States in 2015. Many insurance regulations are directed toward governing the qualification and behavior of insurance agents. Jeffrey Johnson is a legal writer with a focus on personal injury.

Insurance regulation also occurs through the application of other state laws. In 1752 Benjamin Franklin helped form a mutual insurance company called the Philadelphia Contributionship which is the nations oldest insurance carrier still in operation. Insurance companies are also required to act in good faith.

If it were it would be commerce which is regulated by the federal government. Insurance is primarily regulated bythe state鈥every state has its own department of insurance that oversees insurance companies. There is no federal regulatory agency that oversees insurance companiesThe name of the insurance regulatory agency typically is Department of Insurance Division of Insurance Insurance.

However the ACA requires small businesses that offer fully insured healthcare to choose insurance companies. The Prudential Regulatory Authority PRA which is part of the Bank of England promotes the safety and soundness of insurers and the protection of policyholders. As the primary source of contact between insurance companies and members of the general public it is important that agents be properly educated and act in an ethical and professional manner.

State laws require insurers and insurance-related businesses to be licensed before selling their products or services. Your company pays premiums to a health insurance company who in turn provides benefits for employees and assumes the claims risk. Insurance companies in the United States are regulated primarily by the individual states.

Home Legal Insurance Law Health Insurance Government Regulation Who regulates health insurance companies. However where the business has operations permits are necessary. Insurance regulatory law is the body of statutory law administrative regulations and jurisprudence that governs and regulates the insurance industry and those engaged in the business of insurance.

Answer 1 of 4. Currently insurance companies are regulated by each individual state in which they are licensed to do business.

Smart Apple Insurance Buy Your Policy Today Insurance Broker Business Insurance Best Insurance

Best Life Insurance Companies In Us Life Insurance Quotes Best Life Insurance Companies Life Insurance Companies

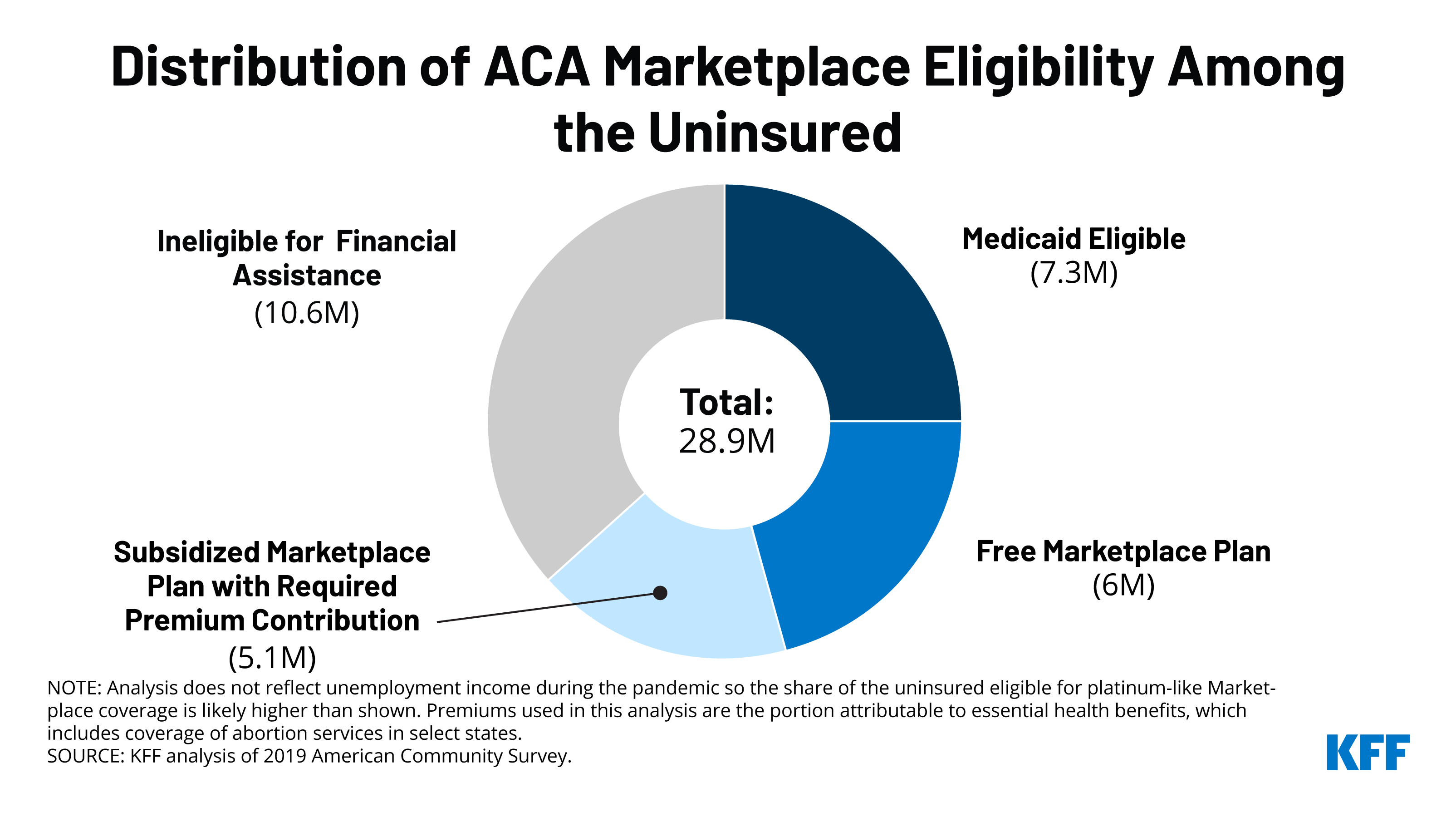

How The American Rescue Plan Act Affects Subsidies For Marketplace Shoppers And People Who Are Uninsured Kff

/insurance-faa9df3f80274172970efdd638aca3cb.jpg)

National Association Of Insurance Commissioners Naic Definition

Who Oversees Car Insurance Companies Autoinsurance Org

Ohio Insurance Commissioner Complaint Diminished Value Car Appraisal Complaints Business Complaints Ohio

U S Financial Regulatory Structure 2016 Financial Regulation Financial Regulatory

Life Insurance Laws By State Fidelity Life

Insurance Regulation Background Overview And Legislation In The 114th Congress Everycrsreport Com

Insurance Is Regulated By States Right Expert Commentary Irmi Com

Pin By The Project Artist On Understanding Entrepreneurship Relatable The Fosters Understanding

Health Insurance Best Health Insurance Good Health Tips Investment Advisor

Cheapest Insurance Policies In Shortest Time Business Insurance Insurance Landlord Insurance

Data Breaches Your Personal And Professional Identity At Risk Health Information Systems Data Driven Marketing Social Data

Health Insurance Co Near Me Medical Insurance Health Insurance Quote Life And Health Insurance

Data Protection Compliance For The Insurance Industry Ekran System

Top 10 Workers Compensation Insurance Companies In The Us Insurance Business America