A bond is a debt obligation like an IOU. You shouldnt shun bonds all together.

List Of Blockchain Use Cases In Insurance Bulletpoint List Blockchain Technology Blockchain Emerging Technology

Source of Fund 1.

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Insurance companies use excess funds to buy long term corporate bonds is. D are affiliated with companies which manufacture or sell goods. The long-term sources are. VBTLX is one of the best bond funds to buy when youre ready to expand.

The fund has a very low expense ratio of 005. Actively managed funds try to outperform the overall markets. Issues a 20-year bond with an issue size of 10 million.

That insurance companies and pension funds buy securities whose value dropped. Insurance bonds are simple investments which allow investors to save for the long term. Corporations issue bonds to fund their operations.

Corporations that accept money from savers and then use these funds to buy stocks long-term bonds or short-term debt instruments issued by businesses or government units. For instance lets say Acme Corp. They will be subject to rules requiring them to be marked to market or listed at current market value at reporting time.

Bonds offer a regular cash payout and their. It intends to sell these bonds at some point in the next 12 months. Sales finance companies A purchase accounts receivable of small firms at a discount.

That insurance companies and pension funds buy. Course Title FINANCE 8. Long-term bond funds can therefore be an excellent trading vehicle but not necessarily the best investment.

In return the company makes a legal commitment to pay interest on the principal and in most cases to return the principal when the bond comes due or matures. Unfortunately these funds have volatility in spades. In return the company agrees to pay interest typically twice per year and.

Companies with sufficient credit quality that need long-term funding can stretch their loans to 30 years or even longer. Term loans generally have. Future compensation amounts paid on property and casualty policies are more difficult to forecast.

Pages 61 This preview shows page 19 – 21 out of 61 pages. Insurance companies tend to invest the most money in bonds but they also invest in stocks mortgages and liquid short-term investments. This bond fund holds thousands of bonds.

Property and casualty policies are longer term. The initial maturities of long-term debt typically range between 5 and 20 years. Companies issue bonds to finance their operations.

How this role develops will in the long run affect how firms obtain financing for their investments and ultimately lead to growth of the real economy. Investors who buy corporate bonds are lending money to the company issuing the bond. This is particularly true for bond investors who are usually looking to collect income and minimize volatility.

It can sell a share of itself by issuing stock. Bonds will have a predictable return making them less risky but stocks will have a higher return over time. The idea of corporate bonds is simple.

There are two basic ways for a company to raise cash. A corporate bond is an instrument issued by a company to borrow money from an investor by paying interest while the principal is to be returned on maturity. C take in deposits from savers and buy corporate commercial paper.

Loans from Financial Institutions and 5. It represents the ownership capital of a firm. A term loan is a business loan with a maturity of more than one year.

They combine to reflect a wide spectrum of the publicly traded US. In that case the bonds will be classified as a short-term investment. B sell commercial paper and buy long-term corporate bonds.

School University of Kufa. The following points highlight the five long-term sources of fund of a company. Corporations that accept money from savers and then use these funds to buy stocks long-term bonds or short-term debt instruments issued by businesses or government units.

A corporate bond is a loan to a company for a predetermined period with a predetermined interest yield it will pay. To understand bonds it is helpful to. Life insurance companies need to maintain a more liquid asset portfolio.

Or it can take on debt by issuing bonds. For instance say an insurance company buys 10 million worth of corporate bonds. Three important forms of long-term debt are term loans bonds and mortgage loans.

Long-term debt is used to finance long-term capital expenditures. Instead use the Method of 100 to determine how much of your portfolio should be composed of bonds. Companies use bonds to raise funds for Long term projects Buy back shares from ECON MISC at The University of Newcastle.

Breaking the Insurance Business Down Insurance is the. An investor may choose from funds similar to mutual funds. A term loan is a business loan with a maturity of more than one year.

Take the one-week period from March 714 2012. Buy Bonds According to Your Age. They are available from commercial banks insurance companies pension funds commercial finance companies and manufacturers financing subsidiaries.

Term loans generally have maturities of 5 to 12 years and can be unsecured or secured. It will balance risk with a low-cost diversified bond index fund. The type of policies offered by life insurance companies are less focused.

Corporate bond funds are debt funds with a regulatory mandate to invest at least 80 of their corpus in companies that carry the highest possible credit rating AAA. Insurers and pension funds can play as long-term institutional investors has become a central topic of discussion in various fora. Most companies could borrow the money from a bank but they view this as a more restrictive and expensive alternative than selling the debt on.

– People come together and let a corporation invest it in some sort of. Corporate bonds are one way to invest in a company offering a lower-risk lower-return way to play a firms ongoing success compared to its stock.

Bubble Tea Brand Nayuki Raises Usd100 Million Ahead Of Hong Kong Listing Tea Store Bubble Tea Chinese Tea

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

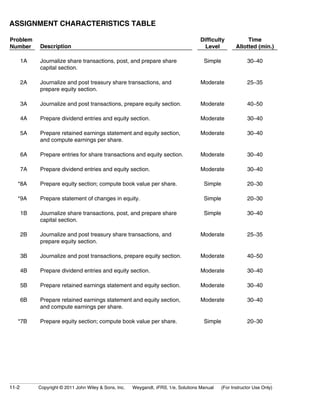

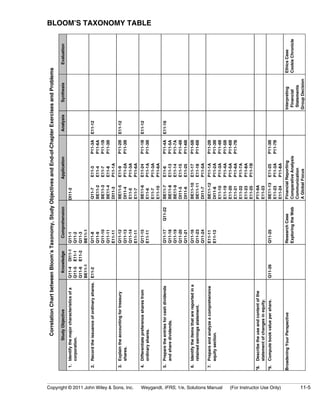

Ch11 Solution W Kieso Ifrs 1st Edi

/GettyImages-183427329-7daf2c51c7ad4af0b946413a2eefa947.jpg)

What Is The Main Business Model For Insurance Companies

Lease Contract With Keys And Glasses Close Up Ad Contract Lease Keys Close Glasses Ad Lease Being A Landlord Contract

Know About Tax On Mutual Fund And Taxation Rules Mutuals Funds Mutual Funds Investing Investing

Ch11 Solution W Kieso Ifrs 1st Edi

For More Detail Read The Article On Http Http Applypersonalloans Sg Unsecured Credit Debt Limit Singapore Unsecured Loans Credit Counseling Credit Card

Know About Tax On Mutual Fund And Taxation Rules Mutuals Funds Mutual Funds Investing Investing

Life Insurance Universal Variable Universal Life Insurance Defined Life And Health Insurance Life Insurance Marketing Ideas Life Insurance Quotes

Polymer Clay Dolls Http Bit Ly H7ayqt Polymer Clay Dolls Kokeshi Dolls Polymer Clay Projects

Know About Tax On Mutual Fund And Taxation Rules Mutuals Funds Mutual Funds Investing Investing

Ch11 Solution W Kieso Ifrs 1st Edi

Do You Prefer Poison Or Antidote Deflation Market Amazon Stock Missing Money Chart